What do you do first (when buying a house and you are over 50)?

MY TOP TEN, START WITH YOUR WHY

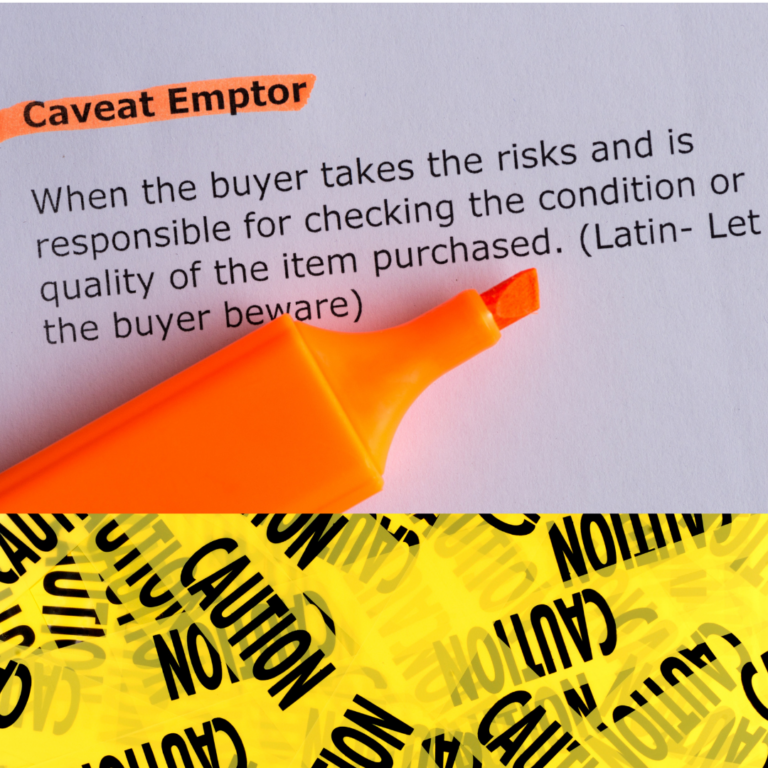

Buying a house when you are over 50 is different than when you are 30 or even 40. It may sound harsh however a mistake will generally be more costly as changing a home or selling a home incur costs that will take time to recoup.

First, work through your motivation, why are you wanting to buy, what has necessitated this move? Whatever your reason, it is your reason and belongs to you so own it and remember it.

Secondly, who else is involved in your decision-making? Family can be so very helpful but realistically, if they are not paying for it then their input can put you off track and make you doubt your choice. If you have children living with you still (even as adults they are still your children) then how long will they be living with you, what is the intention? Don’t buy a house that suits them because they can up and leave at any time and you could get stuck with a home that doesn’t suit you, in a location that you don’t like.

Thirdly, know what you want. What are your Top 10 things/parts that you want in your new home? It could be location – walk to coffee (that’s one of mine), size of the home, floorplan of home, style of home, features of the home, home construction, land size, land composition, renovated, unrenovated or in need of some renovation and of course, price.

Fourth, create another list. What are your needs? You want three bedrooms but you need two bedrooms and a place to study or work. Take your ‘Want’ list and pare it back. You ‘want’ a garden large enough to grow vegies but you ‘need’ a garden that you can grow enough vegies for YOU, not the whole community. Put a lot of thought into this list.

Fifth, another list. ‘Must have’ if the home does not have this then you will NOT buy it. Personally, I must have a garage that has direct house access, it makes me feel safer. I could forgo a bedroom to get this. Keep this list. Laminate it if you need. At every home that you see, refer to your lists.

Buying a House, the money, the legals, time and stress

Sixth, understand your financial position. Will you need a loan when buying a house? Do you have a 10% deposit? How much can you spend? How much do you want to spend? What is your absolute maximum price, your walk-away price? How much will the stamp duty be?

Seventh, who else is involved when you buy a house? You will need a conveyancer, insurance, a building and pest inspector, maybe a lender, and an advocate who can work through this entire process with you is a huge bonus.

Eighth, work on your time frames. Buying a house first, selling first or will you try to do both simultaneously? Do you have a hard time limit that you need to be in your new home or is it flexible? Settlement time will form part of your Contract conditions.

Nine, understand your personal stress points, your influencers, your wants, needs, must-haves, your money, and your timeframes. If you understand what causes you stress then you avoid them or work through them.

Ten, buying a house and how to actually work through the process. I will work through this process with you in my next blog.

Please remember, buying a house and selling a home are right up there with stressful experiences. You are not alone in feeling nervous or stressed. You can do this and if you need help then ask for it. I offer a MEET-UP service, where you can book a time, and for 30 minutes you can ask questions or get reassurance. It’s worth it.